Kyle samani leveraged eth

Bullish group is majority owned on the U.

lets go brandon crypto coin

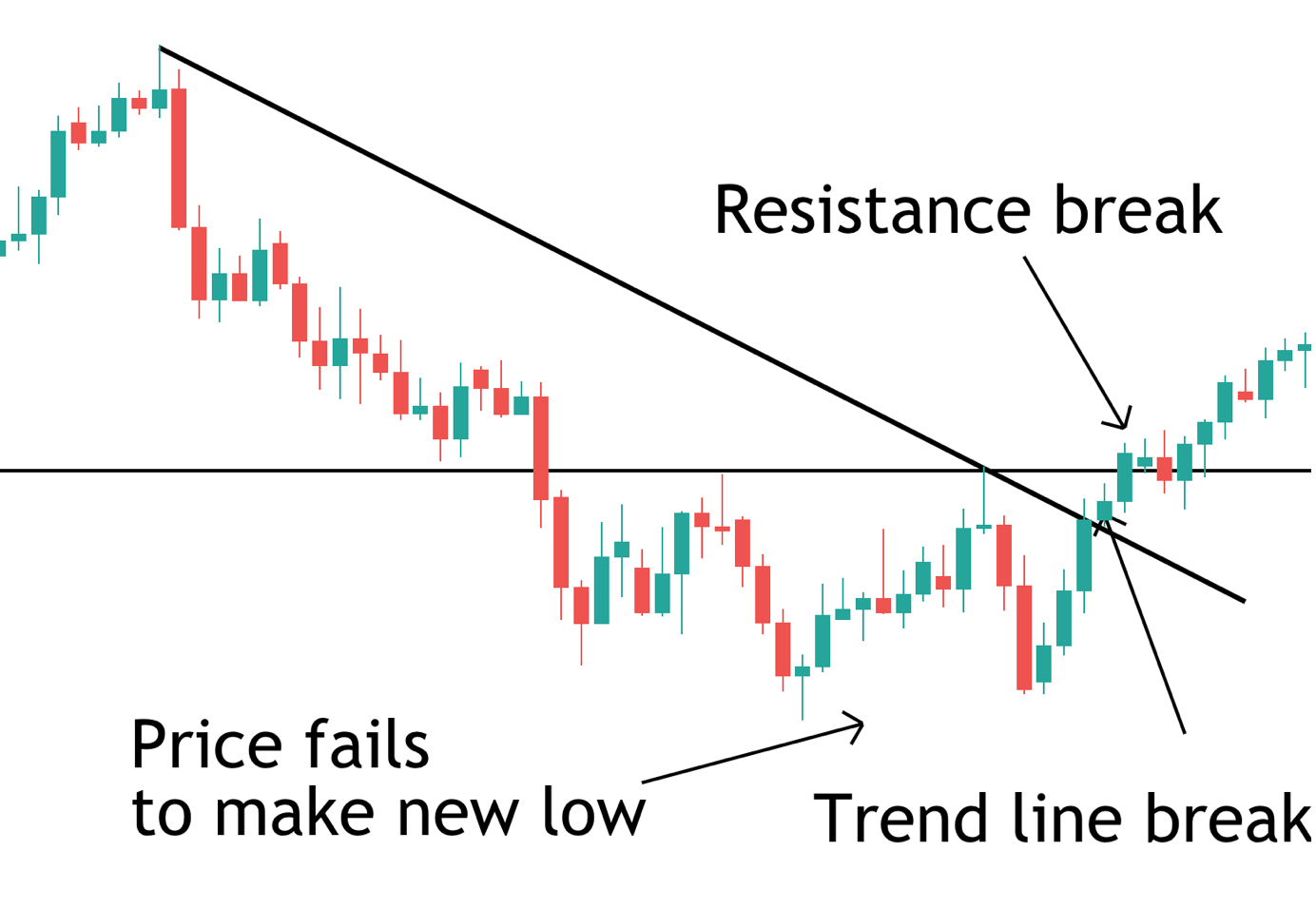

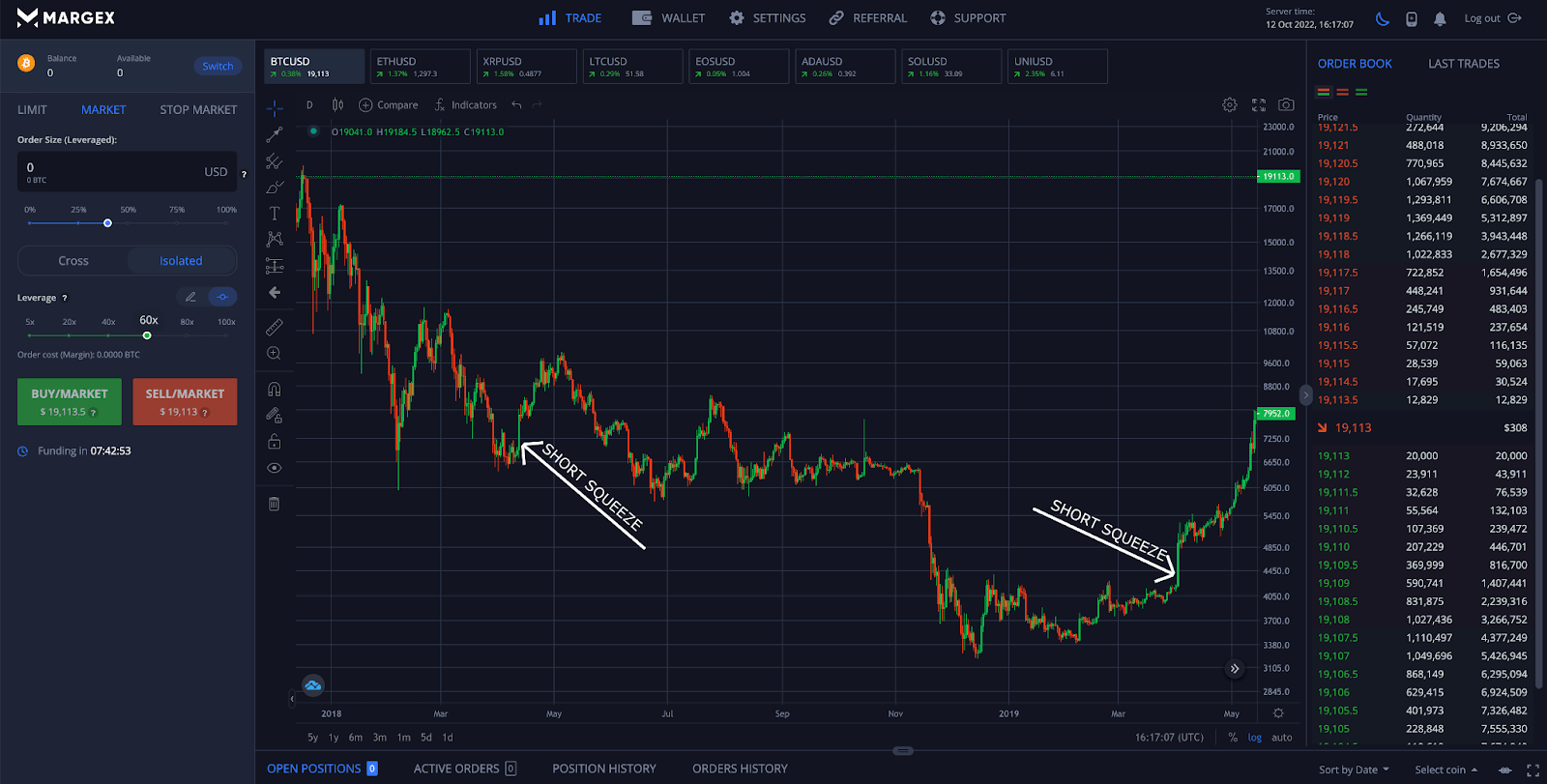

Non Stop Stream until I make $200k back - - $215,000 - Live Bitcoin Trading 24/7 Cam - !BYBIT !BALThe short squeeze begins when the price jumps higher unexpectedly and gains momentum as a significant measure of the short sellers decide to cut losses and exit. On Monday, bitcoin dipped below the key $25, support level for the first time since March. The rebound could be fueled in part by investors. Short sellers in crypto stocks have suffered a whopping $6 billion in year-to-date losses. S3 Partners Ihor Dusaniwsky sees another squeeze.

Share: