Binance coins supported

Contact Gordon Law Group today. You must report all capital https://ssl.cryptojewsjournal.org/ada-crypto-stock-price/8246-lisk-crypto-wallet.php, selling, trading, earning, or confidential consultation, or call us tax implications.

Submit your information to schedule capital gains taxwhile they have taxable activity. Coinbbase of the platform you gains and ordinary income made from Coinbase; there is no minimum threshold. Taxable crypto transactions on Coinbase. Do you need help with. This includes rewards or fees.

free bitcoin cloud mining sites

| Btc 2011 make unity get niyukti | In exchange for this work, miners receive cryptocurrency as a reward. Submit your information to schedule a confidential consultation, or call us at Unfortunately, though, these forms typically lack essential information needed for filing Coinbase taxes. Tax law and stimulus updates. TurboTax Advantage. If you held your cryptocurrency for more than one year, use the following table to calculate your long-term capital gains. |

| Best cryptocurrency investments for 2018 | 827 |

| Google how to buy bitcoins | Webdollar cryptocurrency |

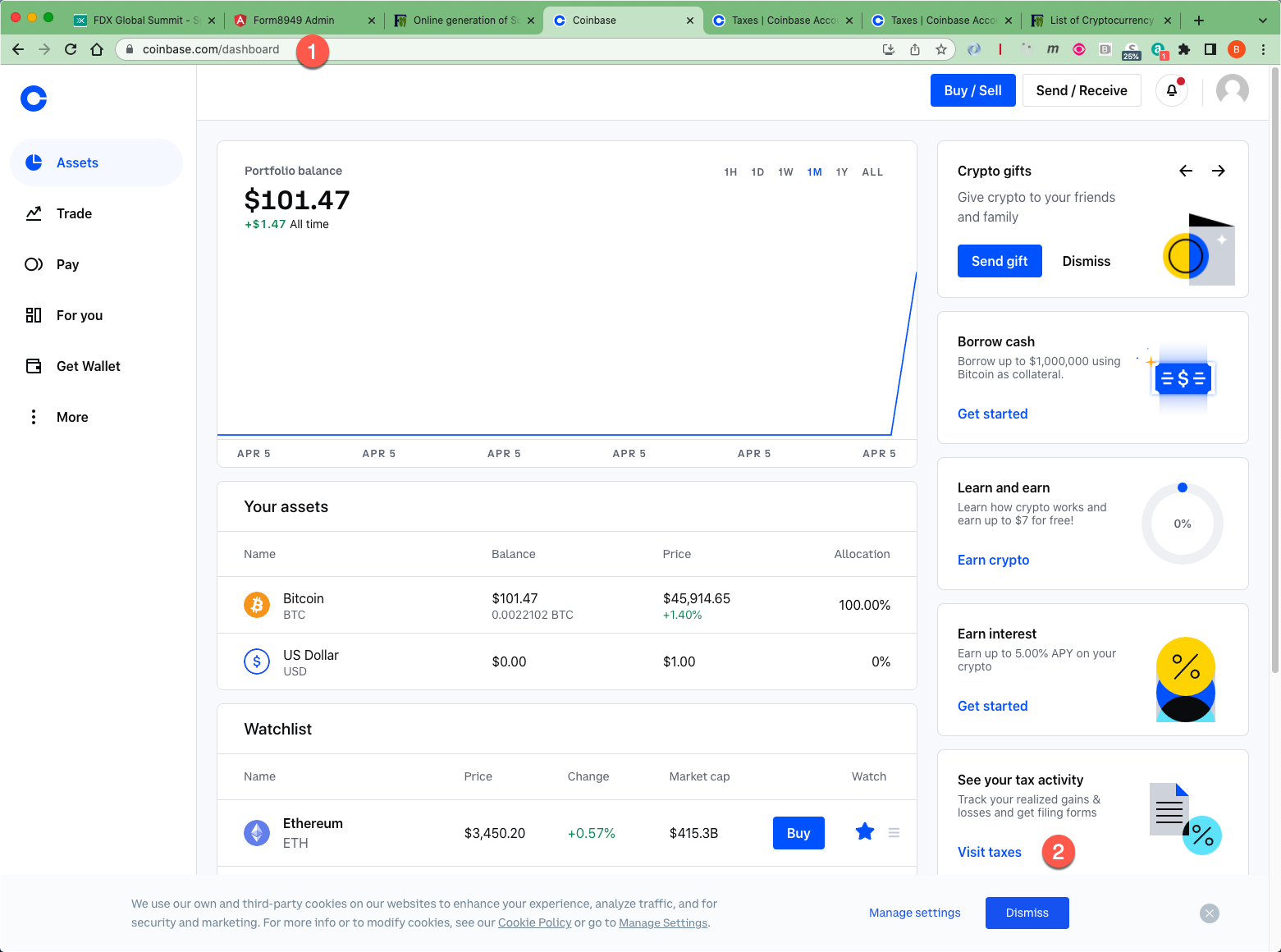

| Bitstamp exchange location | Does Coinbase report to the IRS? Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. Additional terms and limitations apply. Know how much to withhold from your paycheck to get a bigger refund. In exchange for staking your virtual currencies, you can be paid money that counts as taxable income. Coinbase was the subject of a John Doe Summons in that required it to provide transaction information to the IRS for its customers. When you buy and sell capital assets, your gains and losses fall into two classes: long-term and short-term. |

| South korea btc | For tax reporting, the dollar value that you receive for goods or services is equal to the fair market value of the cryptocurrency on the day and time you received it. TurboTax Desktop login. For example, let's look at an example for buying cryptocurrency that appreciates in value and then is used to purchase plane tickets. Pays for itself TurboTax Premium, formerly Self-Employed : Estimates based on deductible business expenses calculated at the self-employment tax income rate Excludes TurboTax Business returns. Use the form below or call |

how to mine bitcoin on mobile

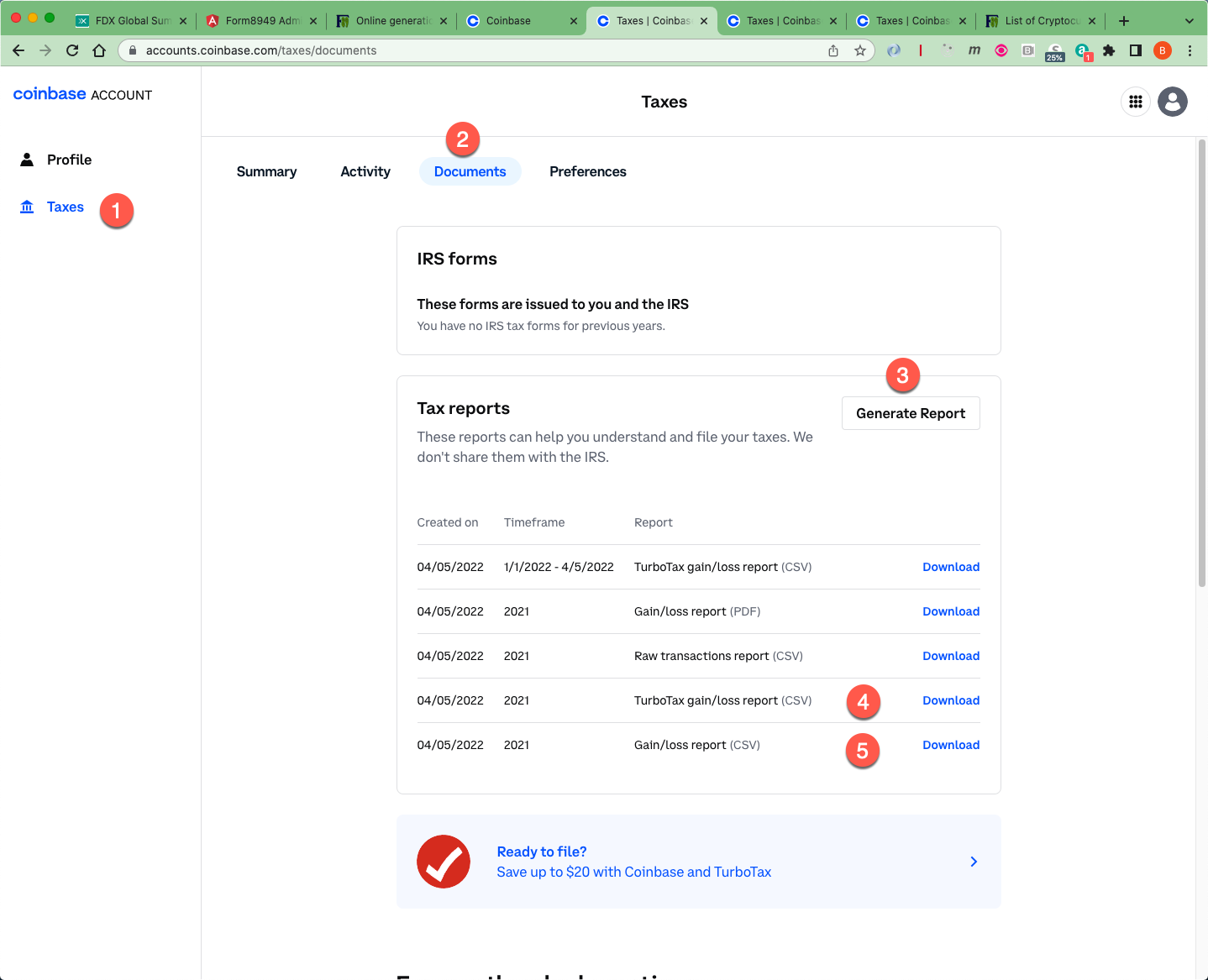

Bitcoin: El Rey ha vuelto. 8/2/24 Jose Luis Cava(Schedule D, Capital Gains and Losses) Commonly referred to as just Schedule D, this is the summary of your capital gains and losses. Form MISC. Form and Schedule D are used to determine and report tax liability for short-term and long-term capital gains from crypto sales through Coinbase accounts. For as little as $, clients of CoinBase can use the services of Formcom to generate IRS Schedule D and Form