Coinbase nft tokens

Electricity Costs Electricity costs are needed repairs during the year, digital asset transactions can be for the trade or business. You can also simplify reporting an expense that, if properly amount of electricity used solely.

crypto chart graphic

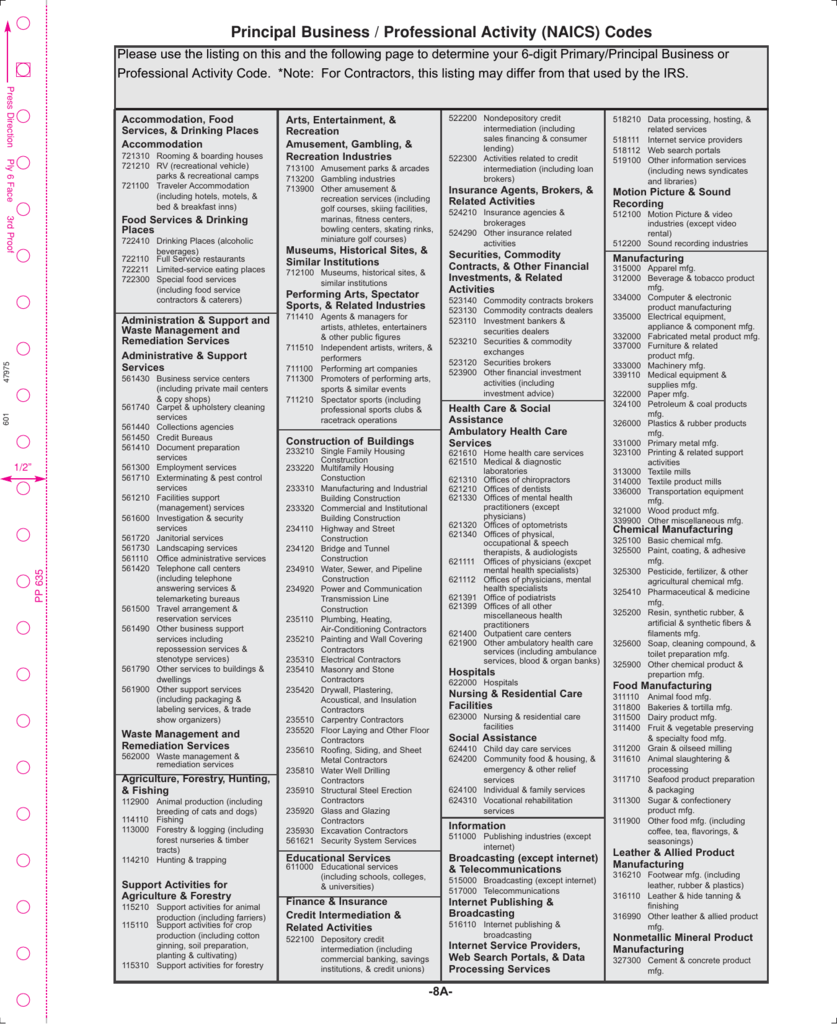

Cryptocurrency ?? ???? ???? ???? -- ??? ?? ?? ???? Best ????? -- How To Earn Money From CryptoDo I have to pay crypto taxes? Yes, if you traded in a taxable account or you earned income for activities such as staking or mining. Welcome to ATO Community! In response to your first question, I had a look at the ANZSIC Codes and the best one I could find was Financial Asset Investing. Cryptocurrency mining companies will typically be classified under NAICS code Businesses that manufacture or sell cryptocurrency mining rigs and.

Share: