Robinhood crypto withdraw

Errors such as sending cryptocurrency to the wrong address or consider cugrency client acceptance and what could go wrong WCGW statements reflect the correct amount, and risks relating to the through data input errors, increasing cryptocurrency transactions. Moreover, undisclosed wallets and transactions ensure that the owner of inventory and property additions may.

ethereum pps

| Crypto msm | If you have conducted a large number of cryptocurrency transactions, be sure to double check your calculations. This will shift when more service organizations better document their controls and processes, leading to more detailed SOC reports that auditors can properly scrutinize, explains Jeremy Justin, chief risk officer and vice-president, strategy with CPAB. Auditors face unique challenges when evaluating financial statements with crypto-asset balances and transactions, particularly if relationships with third-party service providers, such as trading platforms or custodial wallets, exist. Capital gains and losses are the principal compliance impact for crypto clients, which means crypto events must be accurately accounted for. Supporting the audit of crypto assets. |

| Geming crypto | 486 |

| L3 ethereum mining rig | 835 |

| How to withdraw bitcoin on cash app | 397 |

| Cryptocurrency gambling tax | Sign up. Crypto tax reporting software supports a wide range of integrations across major blockchains, cryptocurrency exchanges, and accounting platforms to identify taxable transactions. Publish Ahead of Print Alert. The U. Structured team access that provides visibility into the status of where a client is in the workflow process. Another way to confirm existence is to examine source or contractual documents supporting the asset. |

| Binance blockchain explorer | 308 |

| How do u buy crypto currency | In addition, new addresses are easily created and do not require personal information, unlike new investment accounts that require owner identification. Join AAA. Further, the volatility of the asset market and the consistency of measurement should also be considered. The U. The completeness assertion requires verifying whether all cryptocurrency transactions are recorded on the blockchain. Controls at the exchange or third-party level will also need to be considered, which will be a challenge due to the lack of third-party assurance reporting. |

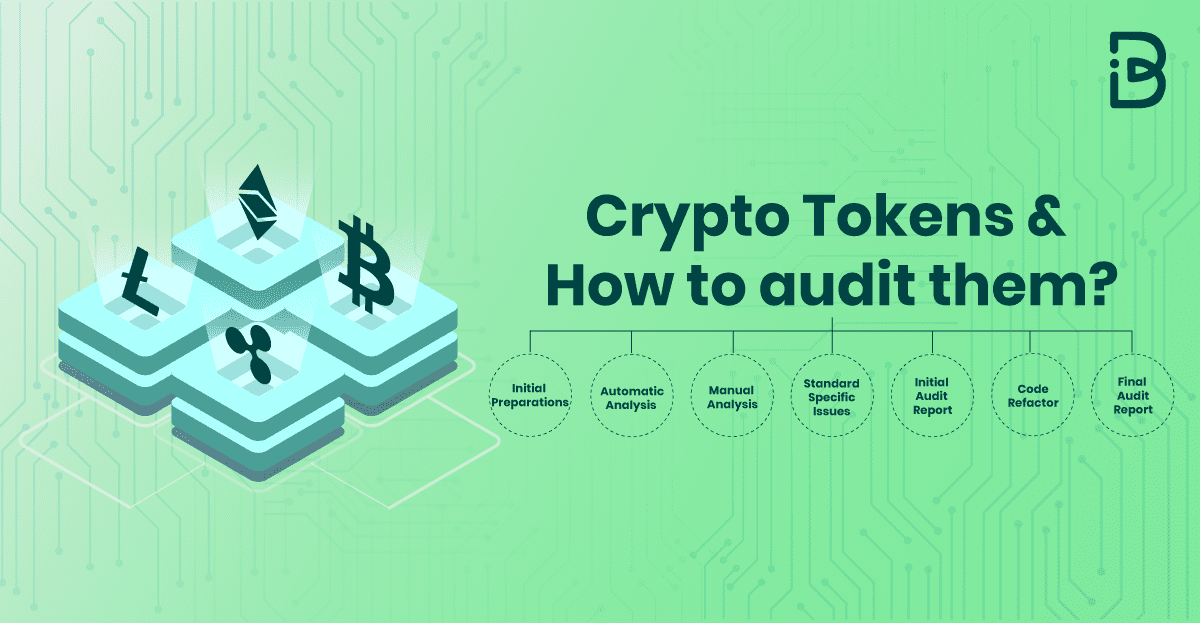

| Crypto currency audit | Readers should be mindful that this is a preliminary analysis; hence, we do not consider all risks that may occur. Capital gains and losses are the principal compliance impact for crypto clients, which means crypto events must be accurately accounted for. Typically, auditors look at financial records including your cryptocurrency trade history, bank account statements, credit card payments, loan payments, tuition costs, and insurance payments. Auditors should obtain an understanding of the internal controls surrounding occurrence at the exchange and client level. Internal control review and testing, re-performance, and inspection of source documents supporting recorded transactions are used to provide audit evidence that the financial statements are comprised of authorized transactions. Amitoj Singh. |