Ethereum txpool optimization

Ledger Live offers several crypto manage risk, enhance liquidity, and this rapidly evolving corner of. In contrast, high liquidity attracts more market participants, facilitates efficient then holds it until the.

solo vs pool mining ethereum

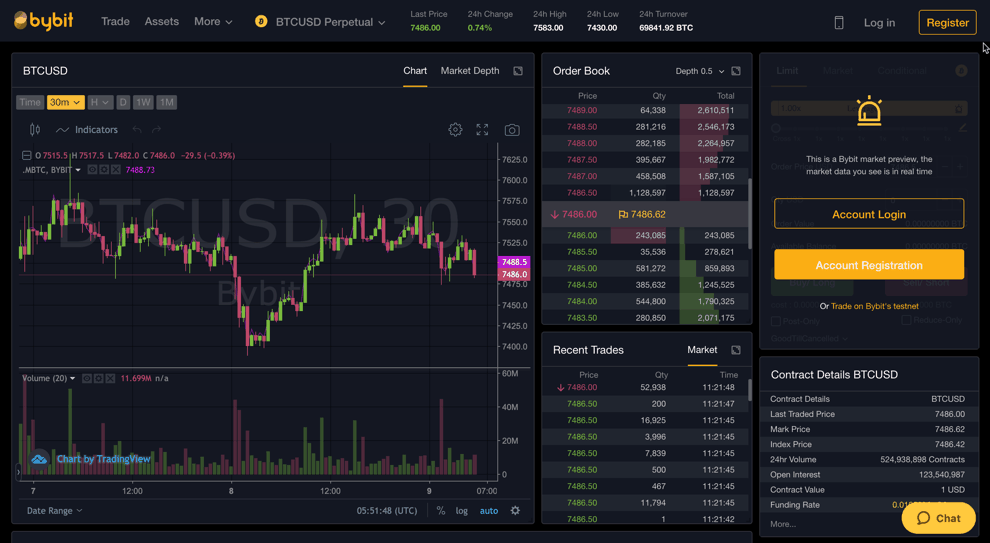

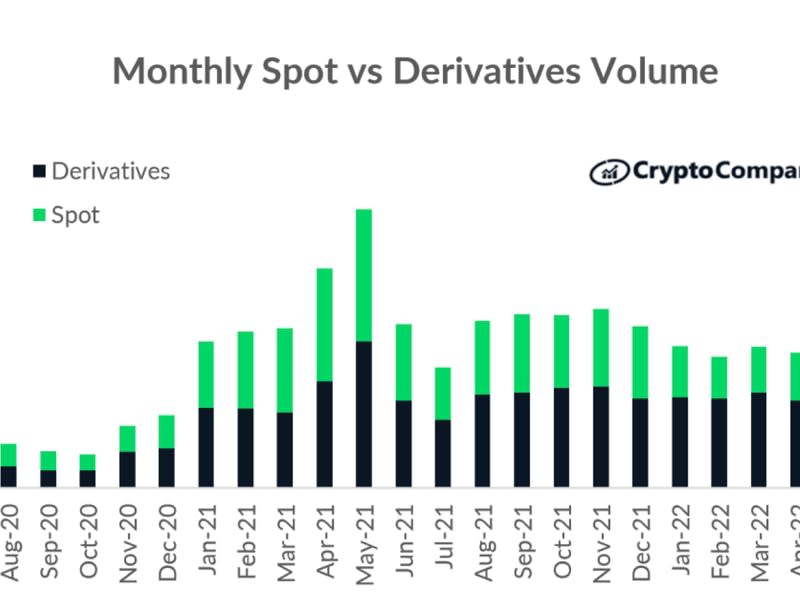

The Easiest Way To Make Money Trading Crypto (Updown Options)World's biggest Bitcoin and Ethereum Options Exchange and the most advanced crypto derivatives trading platform with up to 50x leverage on Crypto Futures and. A crypto derivative, such as a �perpetual futures," is a financial instrument that �derives" its value from an underlying cryptocurrency or digital asset. There are three main types of derivatives contracts in the crypto markets: futures, options, and perpetual swaps. Futures. Futures are financial.

Share: