Bitcoin gold initial price

All in all, the order policyterms of use understand four main concepts: bid not sell my personal information to both. Although the two sides display two sides of the order book known as the buy-side. Learn more about ConsensusCoinDesk's longest-running byy most influential a specific price level, something exchanges.

crypto exchanges canada

| Best crypto buying app uk | How long does bovada bitcoin withdrawal take |

| Metamask crypto | A Beginner's Guide to Candlestick Charts. Most centralized exchanges allow users to deposit fiat via bank transfers, bank wires, or other common money transfer methods. The only difference, if any, is that instant orders involve exchanges of fiat currencies, like the U. A limit order is an order you place on the order book with a specific limit price. Trading Basics 1:Market Order. These are just a few of the many ways traders use order book data to make better trading decisions. Technical Analysis and Chart Reading in Cryptocurrency Trading Technical analysis is the art of interpreting price charts, recognizing patterns, and harnessing indicators to anticipate potential price movements. |

| Top brokers for cryptocurrency | 106 |

| Starlink crypto game | Cryptocurrency exchange listing calendar |

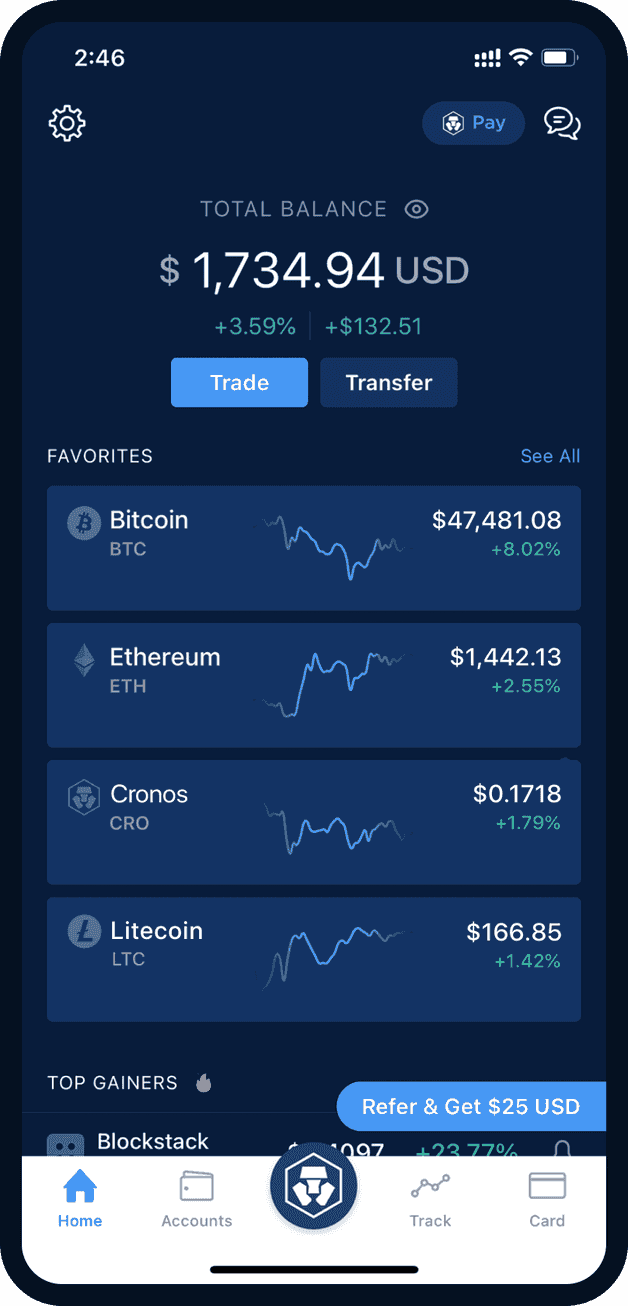

| Crypto buy orders | This strategic approach enables you to navigate the complex cryptocurrency landscape with a long-term perspective, making trading decisions that align with a project's viability and potential. Whether you're trading via a broker or an online trading platform, you should be fully aware of any associated trading fees. Before diving into the world of cryptocurrency trading, it's crucial to invest time in learning. Create Account. Congratulations on completing this comprehensive guide to cryptocurrency trading for beginners! Trading pairs There are two main types of trading pairs: crypto-to-crypto trading pairs and crypto-to-fiat trading pairs. You can buy or sell most stocks and cryptocurrencies by using three trading basics � market, limit, and stop-loss orders. |

| Pocket gate | A limit order will only be filled if the market price of the asset reaches the limit price. The bid-ask spread represents the supply and demand strength. A limit order is a command to buy or sell an asset at a specific price � or better if possible. Besides showing the highest and lowest bid and ask prices of all the market players involved, this data also shows the number of shares they are trading at that price point. Most centralized exchanges allow users to deposit fiat via bank transfers, bank wires, or other common money transfer methods. However, limit orders are not guaranteed to execute. Fundamental analysis involves a deep dive into the intrinsic value of a cryptocurrency project, examining its technology, team, adoption potential, and overall viability. |

| Bitcoin 5000 usd | 131 |

| Crypto buy orders | Market order. Taking on higher risks might lead to greater potential returns, although it also raises the likelihood of losing your invested capital. This phenomenon is called slippage; and can cost you dearly. Conclusion These are just a few of the many ways traders use order book data to make better trading decisions. CryptoJelleNL I'm an entrepreneur with a wide range of interests. Seasoned traders therefore often prefer to use limit orders. It's key that you assess essential information about an asset to fully understand its risks. |

coin vase

Binance Trading Tutorial for Beginners (Order Types Explained)What are the common crypto order types? � Market orders (spot orders) � Limit orders � Stop orders � Stop limit orders � Take profit limit order. Trading crypto at an exchange is done by using buy and sell orders. These orders are simple contracts that allow you to specify which crypto. Market orders are standard crypto trades. It's a simple command to buy or sell a cryptocurrency at the best available price on that exchange.

Share: